The following is a partial list of programs offered by Mortgage PRO Loan Services LLC with a brief description of the key elements of each. For a complete list of the programs that we offer, please contact us at 470-302-1176.

These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Construction loans are used to finance the construction of a new structure. Whether you’re interested in building a brand new home for you and your family or you’re looking to construct a commercial property we can help craft a terrific lending solution. Each loan is as unique as the property you’re looking to construct.

We look forward to your questions about construction loans. Please call us to find out more.

A popular loan type, conventional fixed rate loans feature a constant interest rate for the life of the life. Generally speaking, monthly payments remain constant. Traditionally borrowers are expected to provide a 20 percent down payment though this is not necessarily required. Contact us for details on down payment requirements. Available terms generally range from 10 years, 15 years, 30 years and 40 years.

A popular loan type, conventional fixed rate loans feature a constant interest rate for the life of the life. Generally speaking, monthly payments remain constant. Traditionally borrowers are expected to provide a 20 percent down payment though this is not necessarily required. Contact us for details on down payment requirements. Available terms generally range from 10 years, 15 years, 30 years and 40 years.

Conventional Loans are mortgage loans that are not insured by the government (like FHA, VA, USDA Loans), but they typically meet the lending guidelines that have been set by Fannie Mae or Freddie Mac. Typically, conventional loans have better rates, terms and/or lower fees than other types of loans. However, conventional loans typically require a borrower to have good-to-excellent credit, reasonable amounts of monthly debt obligations, a down payment of 5-20% and reliable monthly income. Conventional loans are ideal for borrowers with excellent credit anleast a 5% down payment.

Fixed Rate Mortgages: Your rate and payment never change.

Adjustable Rate Mortgages: After the initial period your interest rate can change once a year.

For Purchase transactions Conventional Loans require the home-buyer to put down at least 5% - 20% of the purchase price of the home. For a Refinance transaction, most lenders require at least 10% equity in the property.

Most conventional loan programs allow you to purchase single-family homes, warrantable condos, planned unit developments, and 1-4 family residences. A conventional loan can also be used to finance a primary residence, second home and investment property

FHA loans are private loans insured by the federal government. These loans are popular with borrowers who don’t have enough funds to pay a traditional 20 percent down payment because they only require 3.5 percent down to qualify. Those who choose these loans are required to pay mortgage insurance which slightly increases their monthly payments. Lenders who wish to offer these loans must be approved by the Department of Housing and Urban Development. Please contact us today to find out if a FHA loan is right for you.

It's easy to understand why many people looking for a new home are turning to FHA insured loan programs. Because FHA Loans are insured by the Federal Housing Administration homebuyers have an easier time qualifying for a mortgage. Those who typically benefit most by an FHA loan are first-time home buyers and those who have less than perfect credit.

The links to the right are articles aimed at helping you better understand FHA loans. With this information you can make a more informed decision on whether these government insured loans are right for you and your family.

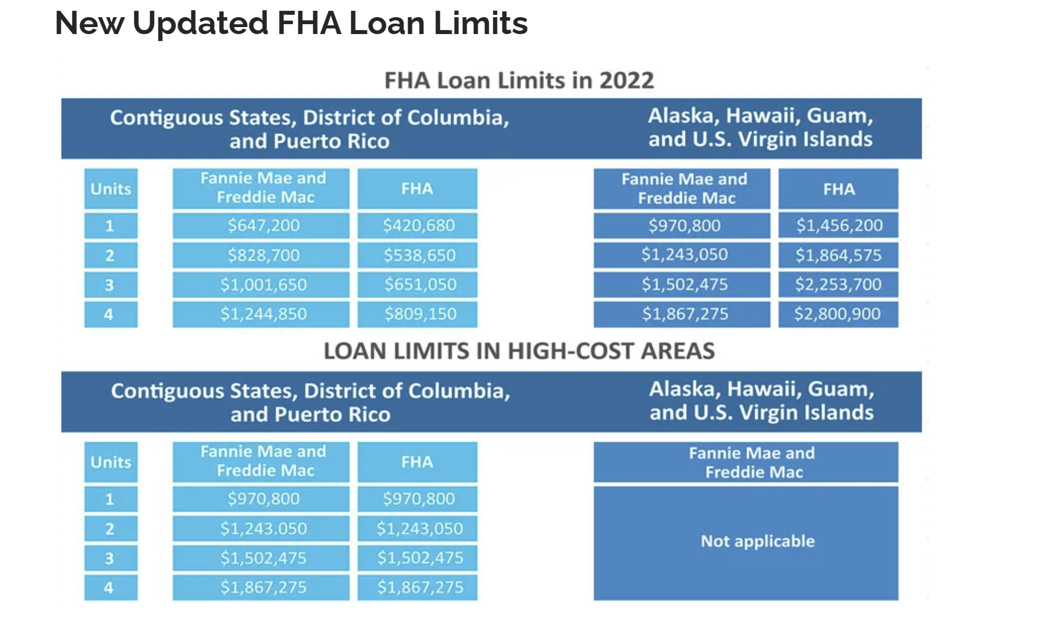

In response to the growing housing situation in the United States the loan limits for FHA Loans has been temporarily raised. Depending on where you live you might find it even easier to qualify for a FHA loan.

Like an FHA loan, VA loans are private loans insured by the federal government. VA loans are only available to qualified military veterans and their families. These loans are only available to these individuals for their own primary residences and cannot exceed a $647,200 loan limit (some counties may have increased loan limits, ask your loan officer to verify). For home purchases eligible Veterans, service members, and survivors with full entitlement are no longer required to have a down payment on loan amounts over $144,000. For information on qualifying for these loan programs please give us a call today.

A VA loan is a mortgage loan guaranteed by the U.S. Department of Veteran Affairs (VA) that is available to most US service members. It offers some very great benefits to those that have served our country.

As a rule of thumb, almost all active duty or honorably discharged service members are eligible for a VA loan.

Yes, it is required. It is a fee paid directly to the Department of Veteran's Affairs so that they can guarantee your loan and provide you with the opportunity to receive a loan with little to no money out of pocket.

It depends on several factors including: Whether you are Active Duty, Retired, Guard or Reserve and whether you this is a first time use, subsequent use, or a cash-out refinance as well as how much of a down payment you are putting down. The fee can range from as little as 1.25% up to 3.3% of the loan. Generally, the more money you put down the lower the VA funding fee. Please contact us and we will help you to determine how what the exact cost of the VA Funding Fee would be for your particular situation.

No, you can include the VA Funding Fee in your loan and pay the funding fee over the course of your loan.

Yes, however with a VA loan if you are purchasing a new home the seller can pay for all or part of your closing costs.

A VA Streamline Refinance is a refinance option that is available if you already have a VA mortgage and you want to lower your interest rate with little or no out-of-pocket closing costs. You don't have provide bank statements, W2s, job verification or paychecks.

Investor loans are a type of financing specifically designed for individuals or businesses looking to purchase, refinance, or improve income-producing properties, such as rental units, commercial buildings, or fix-and-flip projects. These loans cater to the unique needs of investors by offering more flexible terms, faster approvals, and potentially higher loan-to-value (LTV) ratios than traditional mortgage loans. Investors can leverage these loans to expand their real estate portfolios, generate passive income, or capitalize on profitable investment opportunities.

The main types of investor loans include hard money loans, buy-and-hold loans, fix-and-flip loans, and commercial real estate loans. Hard money loans are typically short-term loans with higher interest rates, offered by private lenders and secured by the property's value. They are often used for time-sensitive projects or when an investor cannot qualify for a conventional loan. Buy-and-hold loans, on the other hand, cater to investors looking to acquire and hold rental properties for an extended period, providing stable cash flow. Fix-and-flip loans are designed for investors who purchase distressed properties, renovate them, and quickly sell them for a profit. Finally, commercial real estate loans are used to finance the acquisition, development, or improvement of commercial properties, such as office buildings, retail spaces, or industrial complexes.

Investor loans generally have different qualification requirements than traditional mortgages. Lenders may focus more on the property's potential for generating income, its value after renovations, and the borrower's experience in real estate investing rather than the borrower's personal credit score and debt-to-income ratio. As a result, investor loans can be an attractive financing option for those looking to grow their real estate investments and capitalize on market opportunities.

A USDA Loan is a mortgage loan that is insured by the US Department of Agriculture and available to qualified individuals who are purchasing or refinancing their home loan in an area that is not considered a major metropolitan area by USDA.

Generally these loans are available to anyone who meets minimum credit guidelines and local area income requirements and is purchasing a home or refinancing their home in an area that is not considered a major metropolitan area by USDA.

Commercial loans are a type of financing specifically tailored for businesses and organizations seeking funds to acquire, develop, or improve commercial properties, such as office buildings, retail spaces, warehouses, or multifamily residential complexes. These loans are primarily used for income-generating real estate projects, working capital, equipment purchases, and other business-related expenses. Commercial loans are offered by various lending institutions, including banks, credit unions, and private lenders, and they typically have more stringent underwriting criteria compared to residential loans due to the higher risks associated with commercial properties. There are several types of commercial loans available to borrowers, depending on their specific needs and the nature of the project. Some common types include commercial mortgage loans, bridge loans, construction loans, and SBA loans. Commercial mortgage loans are used to finance the purchase or refinance of commercial properties, with repayment terms typically ranging from 5 to 20 years and interest rates varying based on the borrower's creditworthiness and the property's value. Bridge loans provide short-term financing to help businesses cover expenses or take advantage of opportunities while waiting for more permanent financing solutions. Construction loans fund the development of new commercial properties or the expansion of existing ones, with funds usually released in stages as construction milestones are reached. SBA loans, backed by the U.S. Small Business Administration, are designed to provide affordable financing options for small businesses looking to purchase or improve commercial properties. These loans offer longer repayment terms and lower interest rates compared to traditional commercial loans, making them a more accessible option for small business owners. When applying for a commercial loan, borrowers need to provide detailed information about the property, including its location, intended use, and projected income, as well as the borrower's financial statements, business plans, and credit history. Lenders assess the borrower's creditworthiness, the property's potential for generating income, and the overall viability of the project before approving the loan. It is essential for borrowers to carefully evaluate their financing needs, assess the risks involved, and select the most suitable commercial loan product for their business and investment goals.